How Do Banks Make Money On Zero Interest Loans

5 Minute Read | September 24, 2021

You hear it announced in commercials like it's the deal of the century: zero percent financing! But what exactly does that mean? Let's talk about what zero percent financing is, how it works, who qualifies for it, and if you really need it.

What Is Zero Percent Financing?

Zero percent financing is a marketing tactic offering consumers a loan with a 0% interest rate. The interest rate usually stays at 0% for anywhere from six months up to a few years. After the promotional period has ended, the balance must be paid at a much higher interest rate.

When it comes down to it, zero percent financing just tempts people to buy something right then and there—like a car, furniture or jewelry—that they really shouldn't buy because they can't afford it at the moment.

How Does Zero Percent Financing Work?

Let's use zero percent financing on cars as our example. Car loans with 0% interest are advertised as this awesome deal for you, but it's the dealership who's actually benefitting. They use offers like this to drive sales of a slow-selling model or help make room for new inventory.

And nothing is free—you're actually paying for it in three ways:

Take control of your money with a FREE Ramsey+ trial.

1. Higher price tag: Most zero percent financing "deals" are only offered on cars selling at full price. That means you can't take advantage of a sale, and you're not able to negotiate.

2. Overspending: You're much more likely to overspend when you use zero percent financing to buy something. You'll probably spring for the upgrades and extra features because, hey, you're not paying interest!

3. Payments: You'll be making a lot of payments over a long period of time. Do you really want to do that to yourself?

And seriously, watch out. These contracts are usually written so that when you don't pay off the loan within the allotted time frame, they will go back and charge you the higher interest rate on the original loan amount.

So, let's say you take a 60-month zero percent financing deal on a $20,000 car. You're able to make your car payment of $330 every month for the first couple years, no problem. But then something happens—you lose your job, there's a health crisis in the family, or, I don't know, there's a global pandemic—and you can't make the payment a few times over the course of the loan. The 60-month (or five-year) window comes to a close, but you still have $1,000 left to pay. But now you're going to be charged the new 28% interest rate on the full $20,000 because you didn't quite get it done in time. That's another $5,600 that will be added to your debt!

And that's how they really get you.

Now, you might think you can outsmart the system. You might think you'll be the smart one who beats these guys at their own game. But they created the game, and they made the rules! They know that, more often than not, people don't get the money paid back in time.

Whether it's 12 months or 60 months, a lot of life can happen, and it's just not worth taking on that debt for an asset that's rapidly going down in value.

Who Qualifies for Zero Percent Financing?

In order to qualify for zero percent financing, you'll need a high credit score. The exact range will vary depending on who you're shopping with, but they're not handing out this type of loan to someone who doesn't already have a proven track record with debt.

By the way, if your credit score is higher than the number in your bank account, that's a problem. Don't live your life worshiping at the altar of FICO. I don't care what our society says—it's absolutely possible to save up, pay with your own money, and avoid the stress of debt altogether.

How to Live Without Zero Percent Financing

All zero percent financing means is that you're signing up for a payment on something you can't afford. If you could afford it, you wouldn't need a loan. Paying for things with cash makes life simple and stress-free.

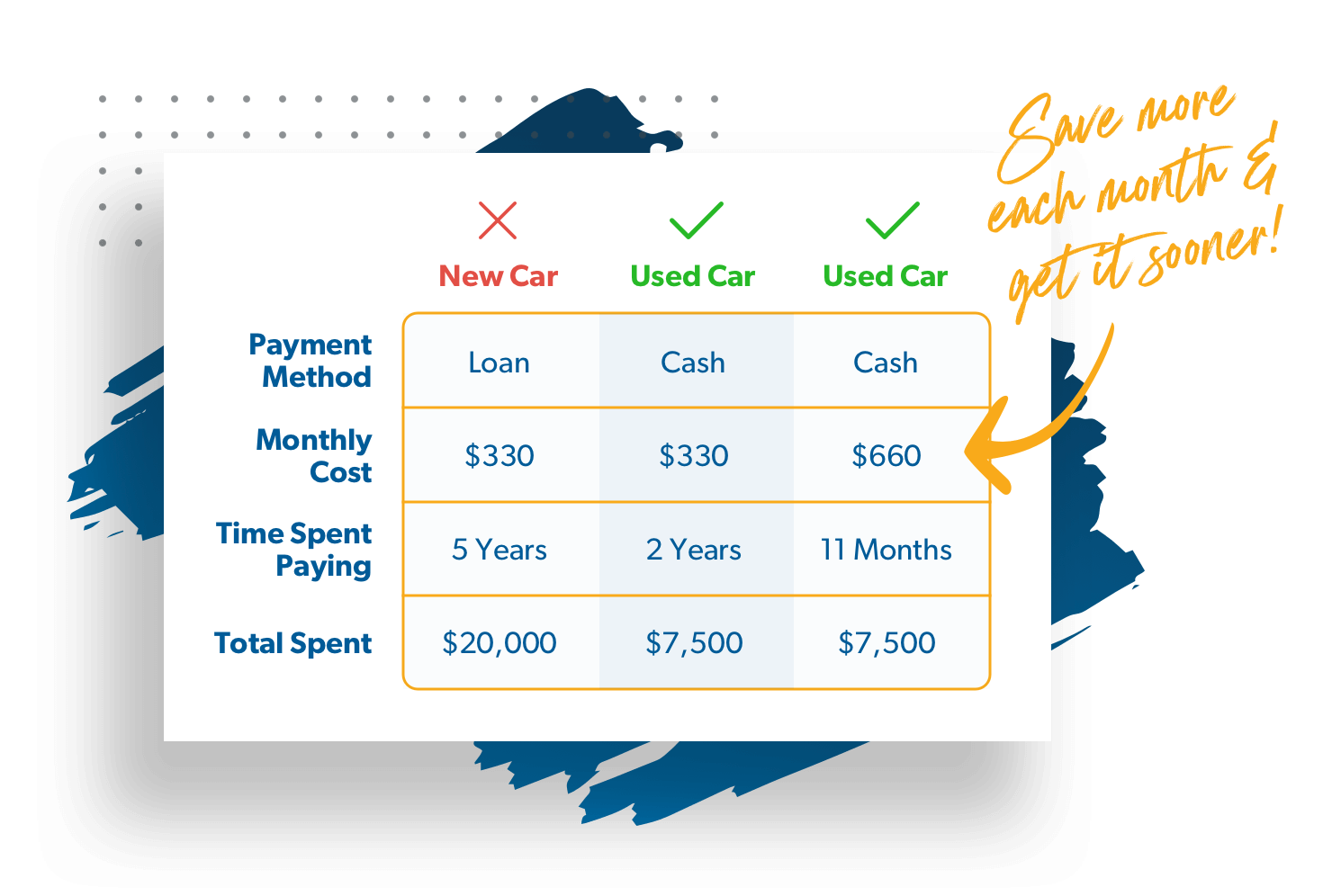

Let's go back to that hypothetical $330 car payment. If you took that payment each month and saved it instead, you'd have $7,500 cash to spend on a reliable, used car in less than two years. But why wait that long? Pick up a side hustle, cut back on eating out, and kick it up a notch! If you put away $660 each month, you can buy the car in just 11 months.

I did a series for The Rachel Cruze Show on the best reliable, affordable used cars because I know you can do this. If you're in the market for buying a car, check them out:

- 8 Reliable Cars Under $8,000

- 8 Minivans Under $10,000

I know that saving up and paying cash for something—especially a car—is the opposite of what most people do. But most people are broke! And once the car is yours—like, actually yours, fully paid for—just imagine the good things you can do with that car payment money. You can do things you actually want to do with it, like fund your retirement, give more to causes you care about, or go to Disney World.

Paying for large purchases without debt might sound crazy, but I've seen millions of families at all levels of income do it. So go for it! If anyone tells you how wrong and crazy you are, just tell them you have zero percent interest in their opinion.

How Do Banks Make Money On Zero Interest Loans

Source: https://www.ramseysolutions.com/debt/zero-percent-financing

Posted by: carrfromeannown.blogspot.com

0 Response to "How Do Banks Make Money On Zero Interest Loans"

Post a Comment